Gold as Collateral: How PGF Tokens Unlock Liquidity with AuUSD

Holding gold is smart. But unlocking liquidity while retaining ownership? That’s smarter. The AuResources platform doesn’t just let you reserve real gold via PGF Tokens—it also lets you leverage that gold to access capital through AuUSD, our ecosystem-native stablecoin. This means you can turn pre-refined, bailment-backed gold into usable digital liquidity without ever selling your underlying asset. In this post, we explore how PGF holders can collateralize their tokens to mint AuUSD, what the loan mechanics look like, and why this functionality expands what it means to “own gold” in Web3.

What You’ll Learn in This Post:

1. What Are PGF Tokens?

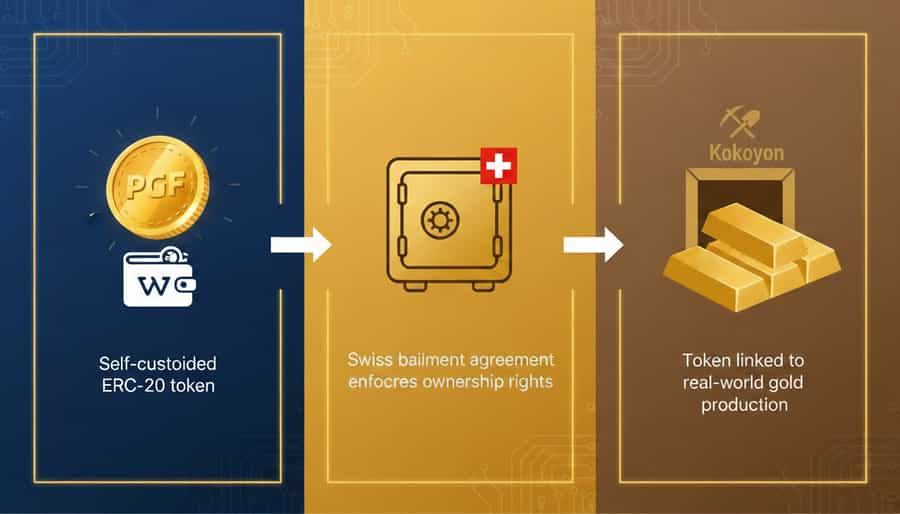

PGF Tokens represent ownership of pre-refined gold held under a Swiss bailment agreement. These tokens are minted in connection with specific gold projects (like Kokoyon) and governed by a defined maturity schedule.

Key properties:

Self-custodied ERC-20 tokens

Tied to real-world gold assets (in-ground or in-process)

Eligible for future conversion or delivery

Qualify as collateral for borrowing

This final point is where AuUSD comes in.

2. AuUSD: A Stablecoin Backed by Real Gold Ownership

AuUSD is a USD-pegged stablecoin native to the AuResources ecosystem. It’s not bought—it’s borrowed by depositing eligible tokens like PGF or AURG into a smart contract vault.

Borrowing AuUSD means you don’t sell your gold. You lock it, borrow against it, and repay when you’re ready.

Use cases:

Liquidity while waiting for PGF maturity

Trading, yield farming, or paying suppliers

Participating in on-chain finance without giving up gold exposure

3. How the Vault System Works

Step-by-step:

Connect your wallet to the AuResources dApp

Deposit your PGF tokens into a vault smart contract

The contract calculates the current Loan-to-Value (LTV)

You borrow AuUSD up to the allowed LTV

Your tokens remain locked as collateral

You repay principal + interest to unlock them

All vault logic is transparent and governed by smart contracts deployed on Polygon.

4. Understanding LTV, Interest, and Liquidation

Loan-to-Value (LTV):

Defined as: (borrowed AuUSD) / (value of PGF collateral)

Varies by token type and market conditions

Interest:

Accrues over time based on smart contract rates

May vary depending on vault type or collateral

Liquidation:

If LTV exceeds a set threshold (due to gold price drop or interest accrual), the vault becomes eligible for liquidation

Anyone can liquidate it

A malus (penalty) is applied to your collateral during liquidation

Any leftover value after liquidation and fees is returned to your wallet

5. Risks and Responsibilities

Borrowing against PGF is powerful, but not risk-free.

Be aware of:

Price fluctuations: falling gold prices can spike your LTV

Interest accumulation: long loans grow costlier over time

Vault lock-in: you can’t move or trade collateralized tokens

Liquidation penalties: you may lose part of your PGF if liquidated

Always monitor your vault health and consider conservative borrowing.

6. Why Use Gold as Collateral?

Gold-backed DeFi offers unique advantages:

Real-world asset backing

Non-correlation with crypto market volatility

Ownership rights stay intact (bailment law still applies)

Enables stable liquidity without taxable sales or giving up upside

This model brings sound money principles to on-chain finance. You’re not minting against hype—you’re minting against proven reserves, refined metals, and legal title.

Summary Takeaways: Turning PGF into AuUSD

PGF Tokens are real-asset utility tokens backed by pre-refined gold

They can be deposited into vaults to mint AuUSD, a native stablecoin

Your gold remains legally yours, even while you borrow against it

LTV, interest, and liquidation are managed via transparent smart contracts

This creates a non-speculative, asset-backed liquidity loop for serious users

Coming Next: We’ll walk through a real-world example of how a miner or investor might use PGF to finance operations using AuUSD—with numbers, screenshots, and timelines.

Visit https://auresources.io to try the vault system or read the latest docs.

Beyond Bullion: Why Micro-Mining is Gold’s Silent Revolution

Gold has always been a symbol of wealth, security, and reserve value. But the process of extracting it has largely remained the domain of large corporations and industrial-scale operations — until now. Micro-mining is changing the equation, offering a leaner, more responsive, and more sustainable model that opens up access to high-grade resources once considered too small or remote for traditional mining. At AuResources, micro-mining isn't just a concept — it’s a pillar of how we connect gold from the ground directly to holders of PGF and AURG tokens. This post explores what micro-mining is, why it matters, and how it quietly underpins a new kind of gold economy.

From Mint to Metal: How AuResources Utility Tokens Unlock Real Gold Ownership

Most gold tokens promise a lot. Few deliver real gold. At AuResources, we believe gold ownership should mean more than watching a price ticker. Our Utility Tokens are built differently: they aren’t investment instruments or synthetic exposure tools. They’re access keys to real, deliverable gold—anchored in Swiss legal structures and backed by a transparent bailment model. If you’ve heard about gold-backed crypto before, this post will help you understand how AuResources brings something entirely new to the table. Welcome to the bridge between Web3 and the world of physical gold.