From Mint to Metal: How AuResources Utility Tokens Unlock Real Gold Ownership

Most gold tokens promise a lot. Few deliver real gold. At AuResources, we believe gold ownership should mean more than watching a price ticker. Our Utility Tokens are built differently: they aren’t investment instruments or synthetic exposure tools. They’re access keys to real, deliverable gold—anchored in Swiss legal structures and backed by a transparent bailment model. If you’ve heard about gold-backed crypto before, this post will help you understand how AuResources brings something entirely new to the table. Welcome to the bridge between Web3 and the world of physical gold.

What You’ll Learn in This Post

How Swiss bailment law governs your relationship with the gold

The full lifecycle of a token: from minting to physical delivery

Why this isn’t a speculative bet, but a custody and delivery framework

How this model compares to custodial ETFs or synthetic gold tokens

1. What Are AuResources Utility Tokens?

Utility Tokens issued by AuResources AG are not securities. They’re access tokens that give holders the right to receive refined gold at a future date, once the metal has been sourced, extracted, and processed.

Each token is tied to a specific project—such as the Kokoyon concession in Mali—with a defined maturity schedule. Upon maturity, token holders can choose to:

Convert to a refined token (AURG)

Take physical delivery (subject to minimums and fees)

Use the token as collateral to borrow AuUSD (our stablecoin)

Borrowing AuUSD against holdings is available to token holders immediately, before maturity. This is a key feature, which we discuss in more detail in our post Gold as Collateral.

This model is anchored in Swiss law and clearly defined in our Terms of Service.

Analogy: Think of the token like a claim ticket for a piece of gold that’s being manufactured. You hold the legal rights to it now, and when it’s ready, you decide how to collect it.

2. The Bailment Agreement: A Legal Structure Older Than Blockchain

When you acquire Utility Tokens through the AuResources platform, you’re entering into a bailment agreement. It’s a legal construct where:

You (the Bailor) remain the rightful owner of the gold the token represents.

AuResources AG (the Bailee) is responsible for securing, refining, or managing that gold on your behalf.

Sub-Bailees (miners, refiners, or vault operators) may be appointed to help fulfill the process.

Unlike staking or pooled custody, you never lose ownership of the underlying metal. The token represents your beneficial claim, enforced under Swiss law.

Analogy: It’s like checking your coat at a secure venue. You’re handing it over temporarily, but it’s still yours. You get a claim ticket (token), and when you’re ready, you pick it up—or have it delivered.

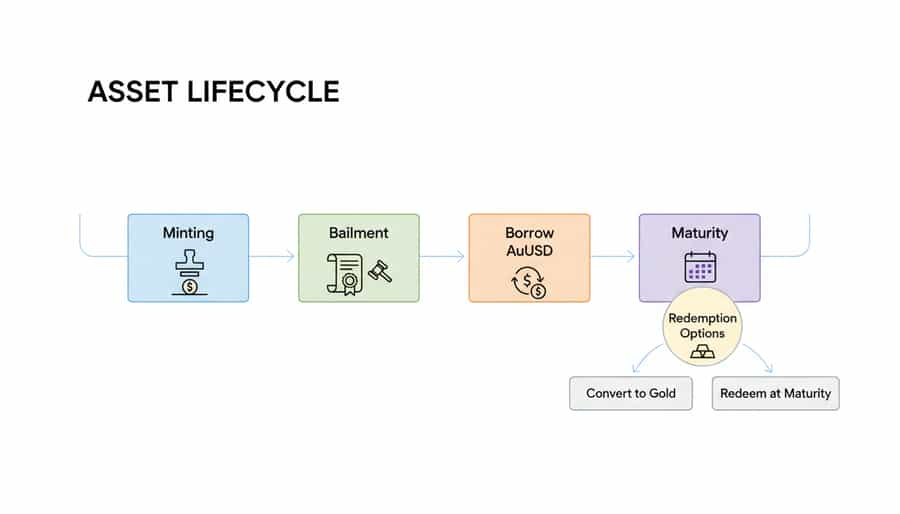

3. From Mint to Metal: The Token Lifecycle

Here’s how the process works from start to finish:

Minting

You acquire Utility Tokens through the AuResources dApp.

These tokens are linked to pre-defined gold projects with known reserves and production timelines.

Bailment in Effect

Your tokens immediately fall under the terms of the bailment agreement.

AuResources sources, refines, and prepares the gold linked to the tokens.

Maturity

Maturity dates vary (e.g., 2027–2029), depending on the project.

Once gold is refined and vaulted, your tokens become eligible for conversion or delivery.

Redemption Options

Convert to AURG (refined gold token)

Request delivery of physical gold (minimum: 10,000 tokens; KYC required; $5,000 fee)

Use the tokens as collateral to borrow AuUSD (covered in our next blog)

This entire process is non-custodial and transparent. You keep control of your wallet and private keys at every stage.

4. Delivery Mechanics: Yes, You Can Get Real Gold

We don’t just promise delivery—we’ve designed it into the token from the beginning.

Delivery conditions:

Minimum of 10,000 matured tokens

KYC verification

$5,000 delivery fee per lot

Government-issued ID required for collection

No third-party proxies

If the original supplier can’t fulfill delivery, AuResources will source the gold from alternative, vetted suppliers. That’s a delivery guarantee, not just a best effort.

5. How This Model Compares to Custodial ETFs and Synthetic Gold Tokens

Key Takeaway: Most gold exposure products stop at price speculation. PGF tokens give you legal ownership, future delivery rights, and utility across DeFi, while staying fully on-chain. This makes them structurally different from ETFs and synthetics — not just another gold token.

To learn more connect with our team on Telegram!

Summary Takeaways: From Mint to Metal

AuResources Utility Tokens represent ownership under a Swiss bailment framework

You remain the Bailor, with AuResources acting as Bailee

Tokens are tied to specific gold production projects with maturity timelines

Upon maturity, you can convert, redeem, or borrow

Physical delivery is available with KYC and fees

This is true gold ownership, not synthetic exposure

Coming next: Learn how to unlock liquidity using your Utility Tokens as collateral to mint AuUSD, our ecosystem stablecoin.

Gold as Collateral: How PGF Tokens Unlock Liquidity with AuUSD

Holding gold is smart. But unlocking liquidity while retaining ownership? That’s smarter. The AuResources platform doesn’t just let you reserve real gold via PGF Tokens—it also lets you leverage that gold to access capital through AuUSD, our ecosystem-native stablecoin. This means you can turn pre-refined, bailment-backed gold into usable digital liquidity without ever selling your underlying asset. In this post, we explore how PGF holders can collateralize their tokens to mint AuUSD, what the loan mechanics look like, and why this functionality expands what it means to “own gold” in Web3.

Funding Hidden Giants

How Gold Mines Are (Usually) Funded — and How AuResources Is Breaking the Mold. Gold mining has always been a game of patience, precision, and — above all — capital. For every glittering ounce that makes its way into a vault or a wedding ring, there’s a decade of exploration, logistics, permits, and infrastructure beneath the surface. The romance of “striking gold” has long since been replaced by balance sheets and financing structures — but that’s exactly where innovation is finally striking back.